With energy demand skyrocketing, electricity-consuming companies are in a race to secure their future supply. But the equation seems unsolvable: nuclear power is decades away, renewables are volatile or costly, and fossil fuels remain an environmental dead end. Yet one industry is already taking responsibility for delivering the stable, affordable power that companies need. And now, a world-unique solution is within reach.

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F09%2FWind-power-Locus-02.jpg)

Only a few years ago, industrial electricity supply was virtually risk-free. Power was steady and reliable, with sources like hydropower, nuclear, and coal plants providing predictable baseload around the clock. As renewable energy has started to account for a growing share of supply, this reality has faded. Now, a surge in wind can send prices crashing. Even well-run energy teams at large corporations face exposure to price swings that are becoming much more difficult to predict.

As variable power becomes the norm, companies also struggle to plan their energy consumption long term – an absolute requirement for investment and growth. Because weather-based electricity carries new and unpredictable risks, fixed-price renewable contracts typically run for only a few years. That makes the business case unworkable for companies seeking long-term commitments to green power.

At the same time, with the EU’s climate targets in place, companies are under pressure to deliver on their own net-zero goals. While the ambition is clear, the reality is not: how to source renewable electricity without taking on excessive risk or paying unsustainable premiums. Until now, that path simply hasn’t existed.

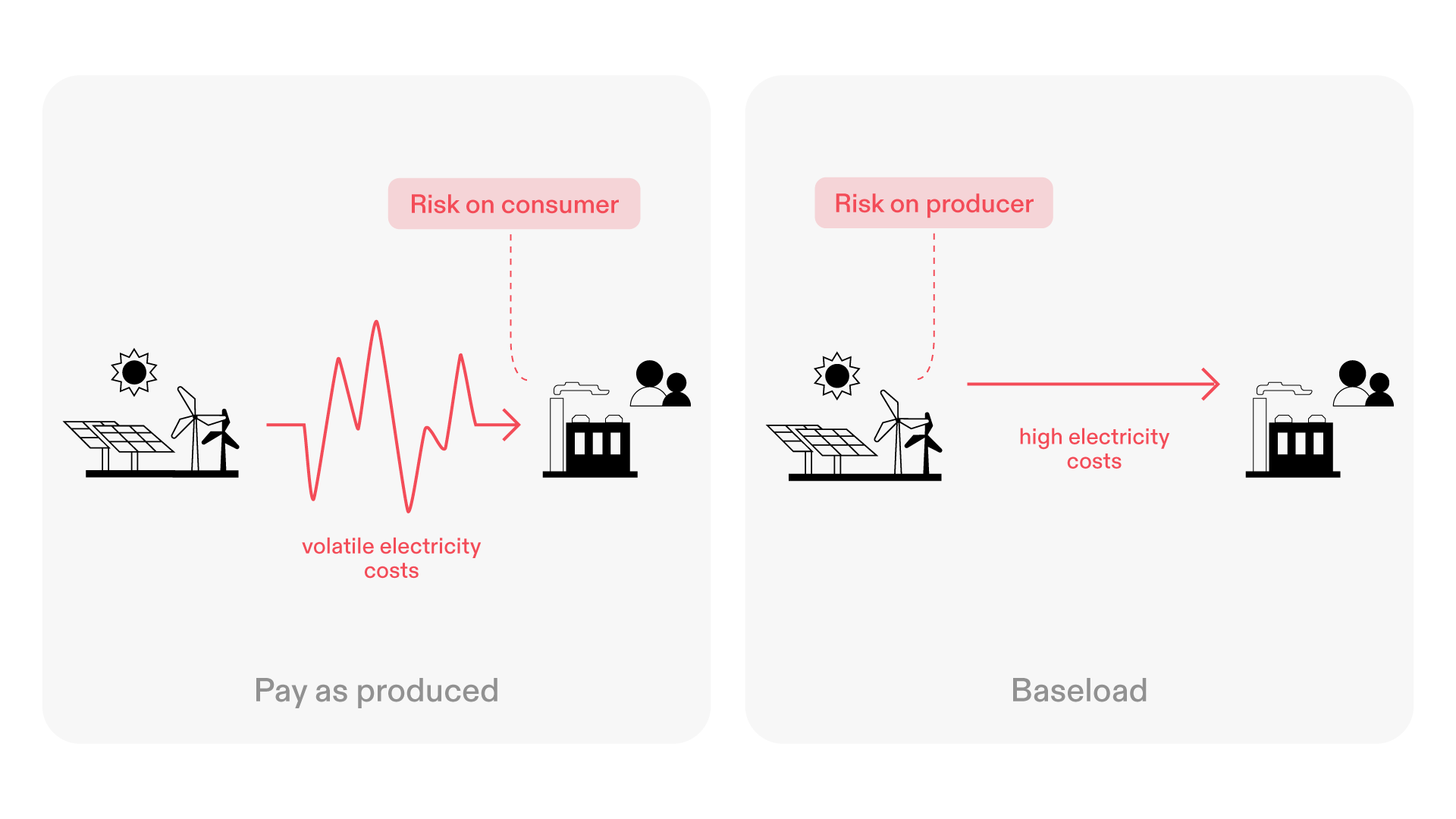

Previous generation’s renewable PPAs (Power Purchase Agreements).

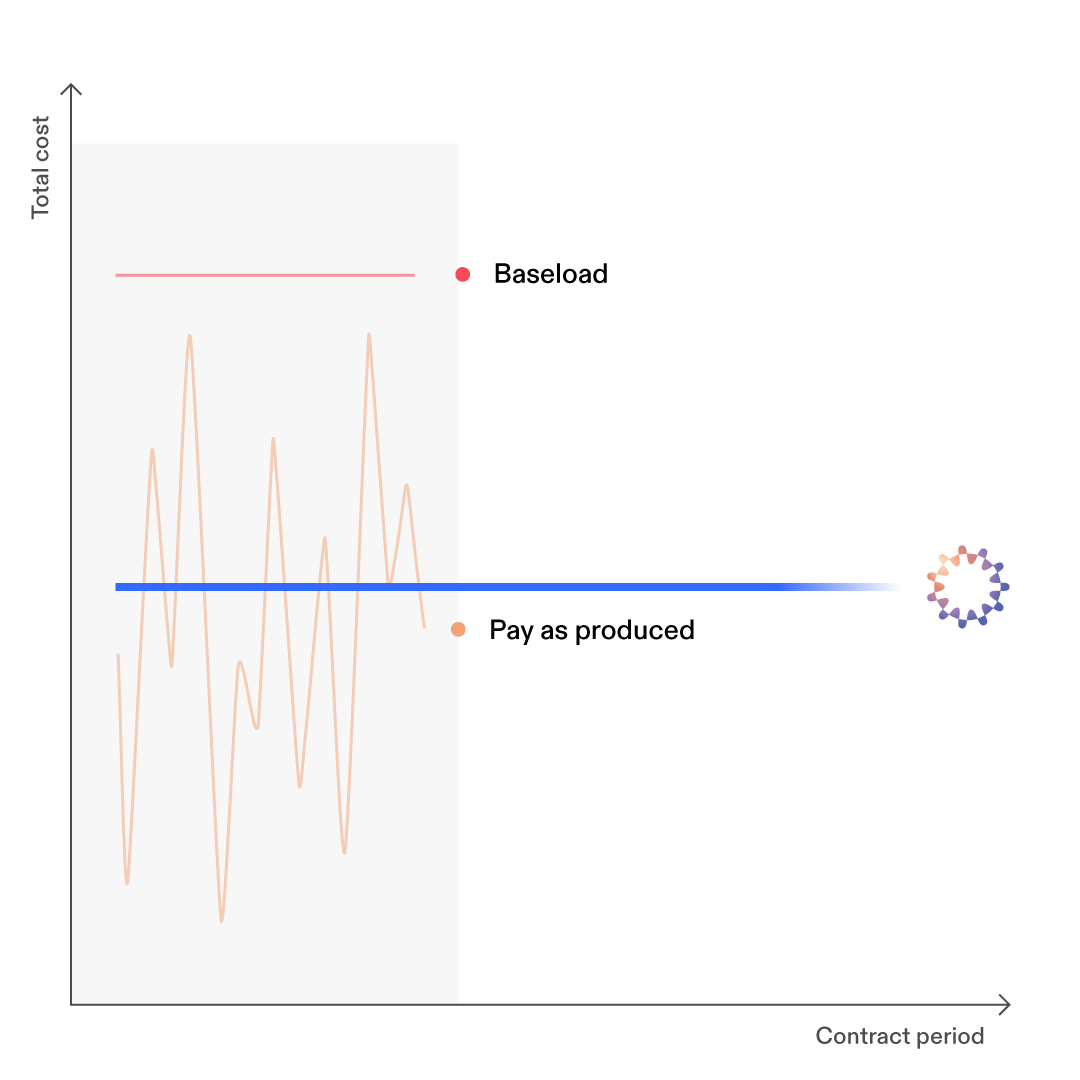

So far, renewable energy has been either volatile or expensive for corporate buyers. Power Purchase Agreements (PPAs) have shifted risks to one side or the other – either onto consumers in Pay-as-Produced PPAs (when the wind doesn’t blow, they are exposed to volatile market prices) or onto producers in Baseload PPAs (forcing them to guarantee delivery while managing market swings). The alternative has been paying hefty premiums to offload risks. In practice, risks have been left unmanaged, leaving renewables risky, costly, and unpredictable.

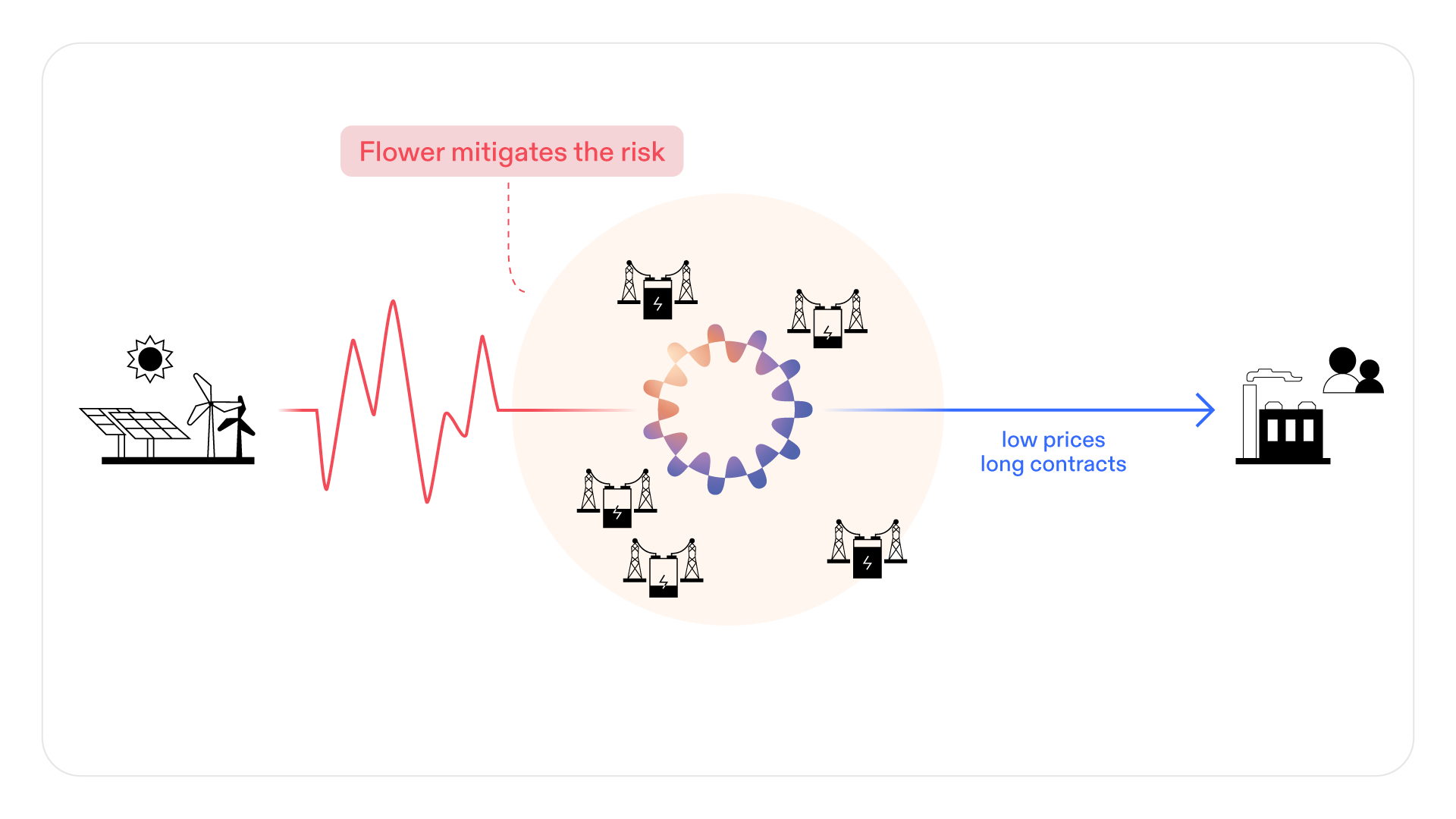

In just a few years, the flexibility sector has outperformed expectations. With rapidly growing assets like grid-scale batteries (BESS), it has built a robust toolkit to hedge the risks of volatile renewable power.

The next generation of renewable PPAs.

When paired with the right advanced software, a large enough portfolio of batteries can be controlled to refine volatile electricity into a stable, reliable supply. This advanced software also drives costs down as it can ensure the most efficient use of the energy assets and the electricity. And because the software is coupled with advanced forecasting and risk modeling, visibility into future risks improves, making long-term contracts possible.

In essence, a new way of reducing volatility is here: using batteries and cutting-edge software to turn renewable electricity into an energy supply that can compete with historically more stable alternatives.

Long-term and affordable renewable contracts are now a reality.

At the heart of this innovation is Flower – a European market leader in advanced energy asset optimization, and the first to provide battery-backed renewable energy contracts to companies. With an innovation known as the Green Baseload, Flower uniquely takes on the risks of renewables, optimizes their performance, reduces volatility, and delivers stable, affordable, long-term PPAs to corporate buyers.

Now in dialogue with some of Sweden’s largest industrial actors, Flower helps companies eliminate volatility and risk from the energy equation while advancing their decarbonization goals – a necessity to ensure business keeps flourishing for the years to come.

Are you a company looking to secure your future green electricity supply? Learn more about the Green Baseload or get in touch to get a quote.

Market insight

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F11%2FDJI_0638_Bredhalla_TomasArlemo_1440x9601.jpg)

Op-ed

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F10%2F22.10.25_John-COP30-01.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F09%2FFlower-flexibility-dot-com-boom.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F08%2FOptimization-Market-Leader-Flower.jpg)