/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F11%2F11.25_PLEXOS-04.jpg)

The rise of weather-dependent energy sources has created an energy sector that is both uncertain and increasingly complex. But with advanced, data-rich risk-modelling software capable of simulating future scenarios – and with experts who know how to interpret the results – this challenge is rapidly being addressed. And now, renewable power contracts are evolving to match the realities of a riskier energy future.

Until recently, coal, gas, hydro, and nuclear defined a global energy mix that was relatively simple, predictable, and low-risk. Operators had direct control over most of the system, and the few uncertainties revolved around rare events: a weak spring flood, delays in fuel delivery, or the occasional reactor shutdown.

Today, the picture is entirely different. Weather-dependent sources like wind and solar are beginning to dominate supply, bringing far more variability – and with it, greater complexity. Where operators once occasionally asked, ‘Will the coal trains arrive on time?’, they now ask every single day: ‘Will the wind blow and the sun shine — and how do we hedge the risks if they don’t?’

“This will define how tomorrow’s leading energy actors operate”

– Patrik Hardin, Lead Quantitative Analyst, Flower

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F12%2F3X2A0123.jpg)

This new reality has driven the development of software tools that can make accurate forecasts based on weather, market, and asset data. But it has also increased demand for advanced modelling technologies that can simulate future energy scenarios at far deeper and more complex levels. These data-heavy tools reveal not only what might happen in the future, but how the scenarios would unfold in practice – accounting for parameters like macro-economic fluctuations, industrial demand shifts, grid constraints, and much more.

Ultimately, it all comes down to mastering one thing: risk.

“Risk assessment is becoming fundamental in the energy system of tomorrow. As portfolios grow in size and complexity, the ability to map trends and price developments far ahead – with data that supports multiple scenarios – becomes crucial. This will define how tomorrow’s leading energy actors operate,” says Patrik Hardin, Lead Quantitative Analyst at Flower.

“With PLEXOS®, Flower can conduct risk assessments at a more comprehensive level than what is typically offered”

– David Robertson, Senior Vice President EMEA, Energy Exemplar

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F12%2FDavid-Robertson.jpeg)

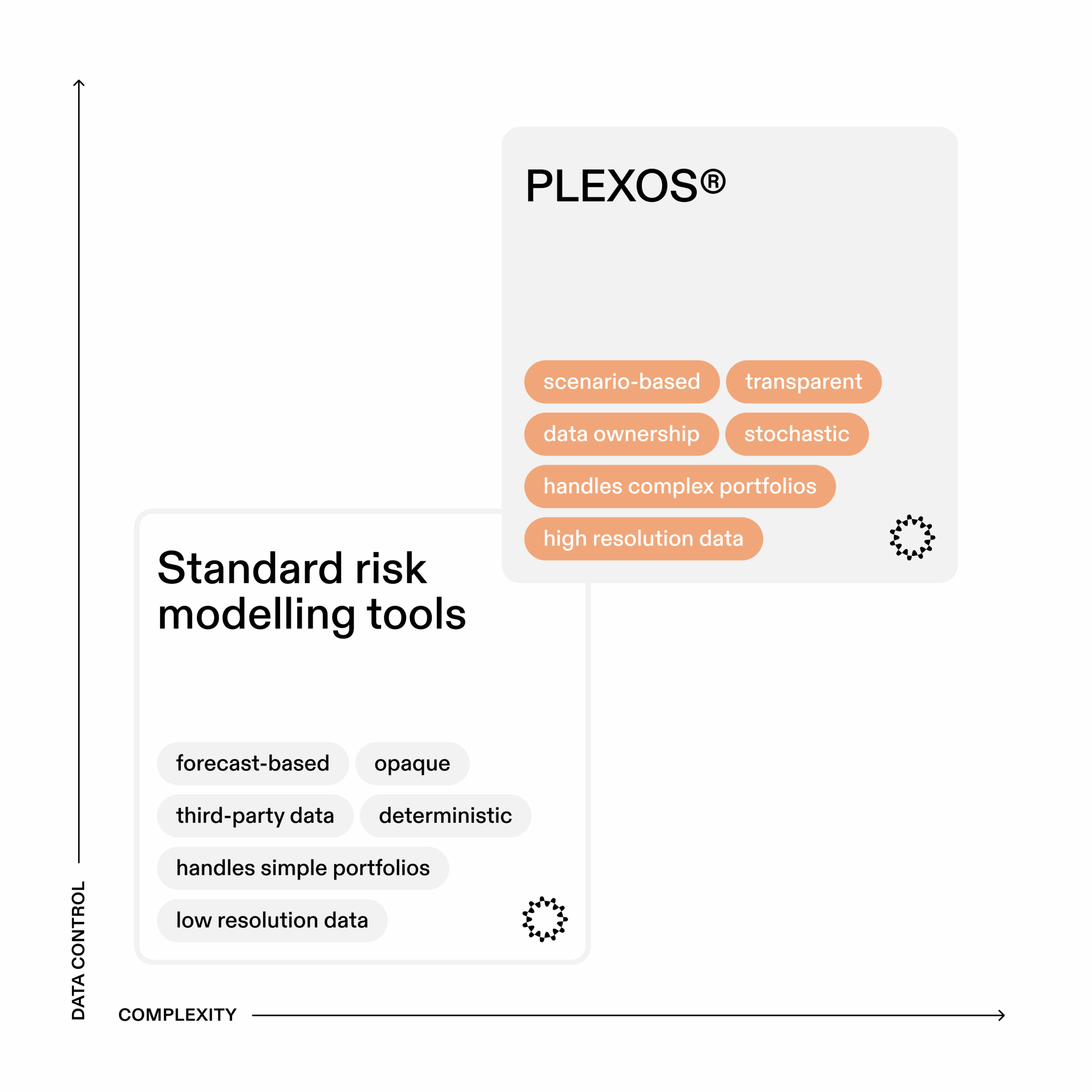

With comprehensive control over a wide range of energy assets like wind and solar farms, battery systems, and EV chargers, Flower quickly realized it needed a tool that could handle risk modelling far beyond standard practice.

Energy Exemplar’s PLEXOS® became that tool: an industry-leading software used by the International Energy Agency, TSOs worldwide, governmental bodies, utilities and many other major energy actors to make sense of future risk factors. David Robertson, Senior Vice President EMEA at Energy Exemplar, explains:

“PLEXOS® is what’s known as a technoeconomic platform, a deep mathematical model essentially showing what energy infrastructure to build, and what not to build, in the future. In today’s fast-moving energy landscape, tools like PLEXOS® are needed to help unify complex data and streamline both long- and short-term decision-making. With PLEXOS®, Flower can conduct risk assessments at a more comprehensive level than what is typically offered.”

Most flexibility actors rely solely on tools that forecast prices, market trends and grid constraints from a bird’s-eye view – using third party data. By contrast, PLEXOS® allows Flower to go into more detail, simulating real-world scenarios and mapping risks and opportunities with increased data transparency.

As the energy system becomes more variable and complex – and as data handling and risk assessment become decisive factors – tools like PLEXOS® offer a clear strategic advantage. According to David Robertson, the value is not only in understanding market and asset risk, but also in establishing credibility.

“Flower is a company that lives and breathes fast growth and deep expertise – with the potential to make a significant impact in the energy sector. With PLEXOS®, companies like Flower gain credibility among financial institutions that value strong in-house risk-mitigation strategies. We’re confident that the tool will be a vital complement as Flower works to enable the energy system of tomorrow.”