A golden goose of tomorrow or an energy market pipedream? The mFRR market has been dominating the conversation in the Swedish trading sphere throughout spring. Following recent significant market imbalances, it is increasingly being recognized as a revenue stream to rely on. Will this momentum continue, or is mFRR destined to mature along the same path as FCR?

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F06%2FHanhals-15-MW-Ellevio-1000x1246-1.png)

In recent years, the rise of intermittent renewable energy sources has accelerated the growth of balancing markets – i.e., energy markets where assets that can smooth out volatility in the grid are traded. One of these balancing markets is the mFRR market – constituting of the mFRR Capacity Market (mFRR CM) and the mFRR Energy Activation Market (mFRR EAM) – an emerging promise in the battery storage landscape that has been an important complement to the recently more saturated, and less revenue-generating FCR markets.

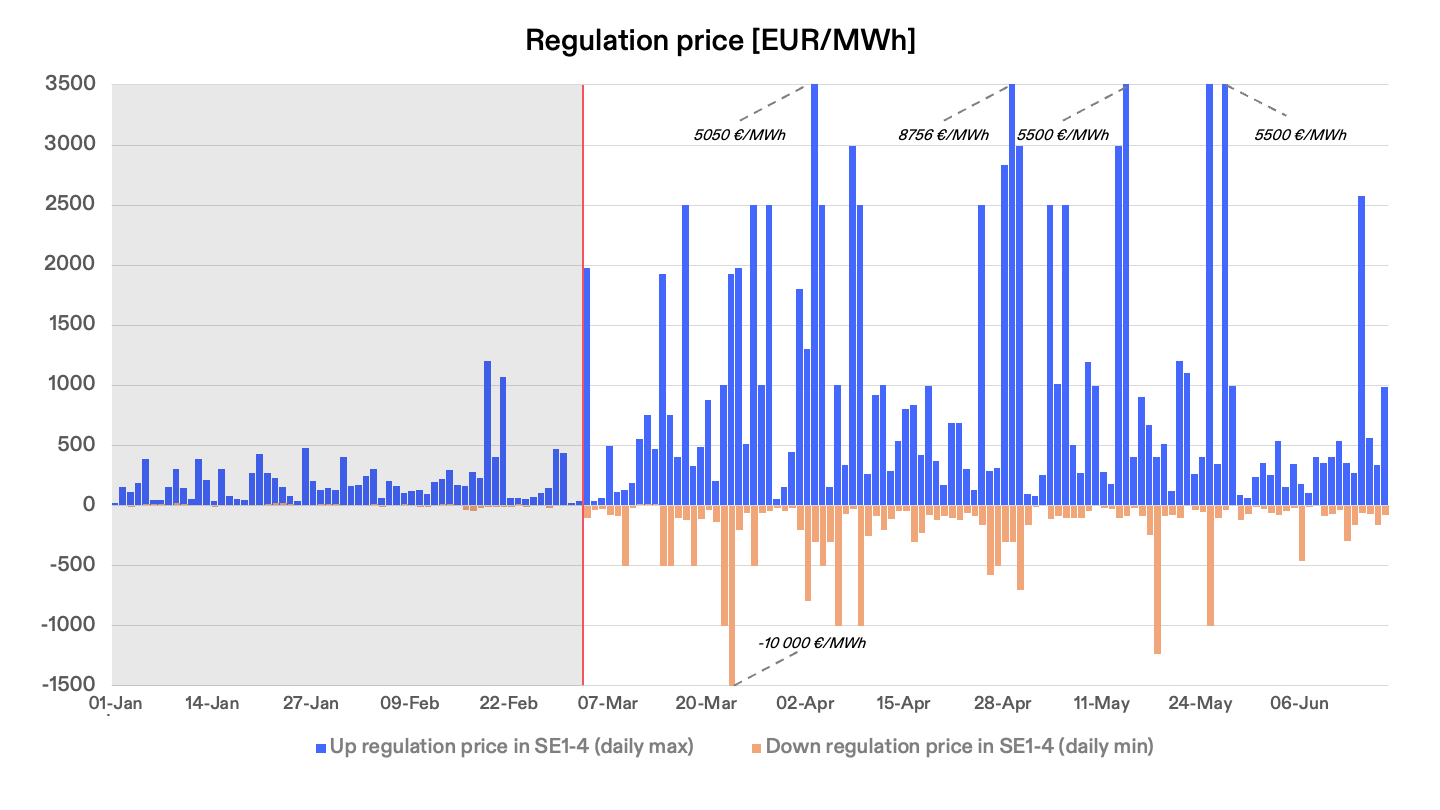

In line with EU regulation, the Swedish TSO Svenska kraftnät, together with other Nordic TSOs, introduced a 15-minute Market Time Unit (MTU) in the mFRR market on March 4 in 2025. This significantly impacted the price during spring.

The introduction of a 15-minute Market Time Unit (MTU) in the mFRR market on March 4, 2025, has prompted the mFRR Energy Activation Market (mFRR EAM) to shift from a previously manual setup to a fully automated process. This transition has contributed to a more volatile market, driving a surge in revenue potential for mFRR – with price peaks previously unseen in the market. Asset owners with flexible assets, such as BESS, are now well-positioned to capitalize on this trend.

The growth of prequalified BESS on mFRR is also taking off. According to the Swedish TSO Svenska kraftnät, the amount of pre-qualified BESS on mFRR Up has increased from 120 MW to 697 MW from January to June 2025. On mFRR Down, the growth rate has been similar, rising from 120 MW to 657 MW. These numbers will likely continue to grow throughout the year.

mFRR is an ancillary service market, but it operates quite differently from markets such as FCR. For one, it is more complex in its market design, as it is divided into two components that serve distinct functions; The mFRR Capacity Market (mFRR CM), where assets are compensated for being available, and the mFRR Energy Activation Market (mFRR EAM), where assets are compensated when actually used. Maximizing the value from this market structure requires a broad set of trading strategies and dynamic coordination between markets.

Participating in either of these mFRR markets also entails greater responsibility for energy actors, who must manage more significant frequency restoration tasks that have a stronger impact on grid stability. This heightened responsibility also comes with the potential for larger earnings spikes, particularly during periods of increased market volatility – as reflected in data from recent months.

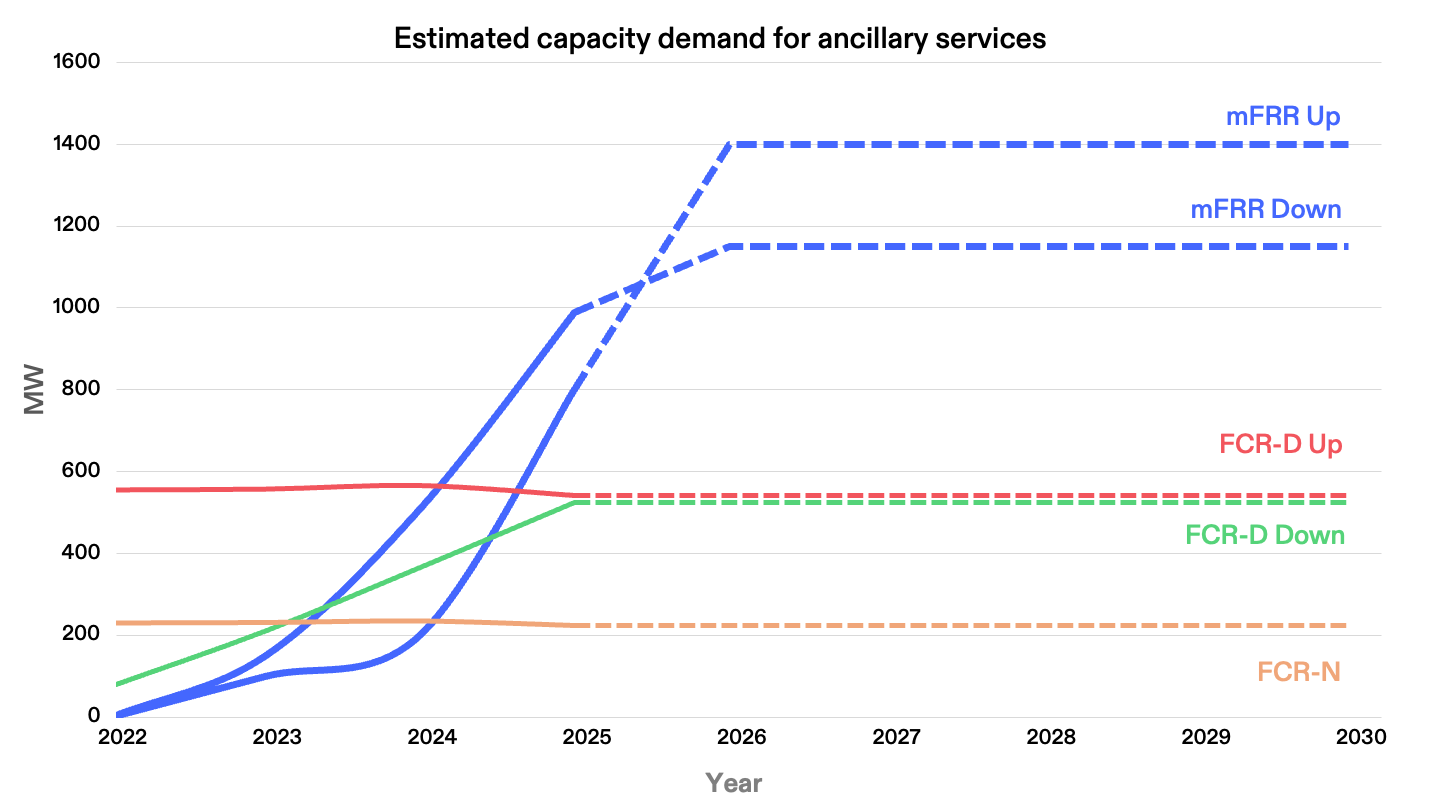

Swedish TSO Svenska kraftnät’s prediction of the future capacity demand for ancillary services show a continued rise for mFRR Up and Down.

Unlike the FCR markets, mFRR is still in an emerging phase of maturity. According to Svenska kraftnät’s analysis of the energy markets, the demand for mFRR will only continue to rise in 2025 and 2026. The Swedish TSO predicts that demand will increase and stabilize at around 1400 MW on mFRR Up and 1200 MW on mFRR Down – a large gap from today but one that is rapidly closing. This is a clear contrast to the FCR markets whose demand caps have already been reached in Sweden, creating less wiggle room here to generate revenue.

The mFRR market has so far demonstrated strong potential since the volatile trend began in March, both on mFRR CM and mFRR EAM. Though the prices on both markets have been trending slightly downwards since then, mFRR still appears more attractive than FCR at present.

Furthermore, unlike other ancillary service markets, mFRR will soon be connected to MARI (Manually Activated Reserves Initiative) – a European platform to coordinate, activate, and price mFRR reserves between countries in real-time. This demonstrates the market’s potential beyond Swedish borders, and an opportunity for asset owners to export capacity to higher priced countries in continental Europe.

All this said, there is no reason to believe that mFRR will be the sole solution for asset owners seeking future revenue. Like the FCR market, the mFRR market depth is not infinite, and a market saturation will eventually stabilize its price curve. Instead, it should be seen as a complementary market to ancillary markets like FCR and wholesale markets such as day-ahead – the latter of which is currently showing the strongest long-term growth potential.

mFRR should be seen as a complementary market to ancillary markets like FCR and wholesale markets such as day-ahead. Photo: Ellevio

To participate in mFRR, assets must be optimized with a BRP (Balance Responsible Party) that can access markets beyond FCR-D and FCR-N. Ideally, this partnership is with an in-house BRP rather than a third party provider, to maximize market flexibility and speed. Although this is a good first step, this BRP optimizer should also be capable of trading with advanced algorithms that can automatically allocate across several markets and assets, factoring in everything from market depth to grid tariffs in their strategies. This is essential to effectively spread the risk and maximize value across the entire energy market palette.

As an in-house BRP with industry-leading algorithms, Flower has extensive market access combined with a deep knowledge of the energy market. With its cutting-edge trading models already carrying out smart trading on mFRR, Flower is optimizing profits across mFRR and all relevant markets and continuously iterating on trading strategies to capitalize on market developments.

The mFRR market may be the talk of the town, but the future of trading won’t be defined by a single high-potential market – regardless of how its prices develop over the coming years. Rather, it will be shaped by advanced risk management, algorithms that are trained on thousands of scenarios, and skilled people capable of interpreting them – all working together to unlock the future’s most profitable energy assets.

Market insight

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F11%2FDJI_0638_Bredhalla_TomasArlemo_1440x9601.jpg)

Op-ed

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F10%2F22.10.25_John-COP30-01.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F09%2FWind-power-Locus-02.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F09%2FFlower-flexibility-dot-com-boom.jpg)